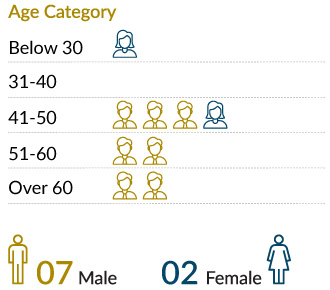

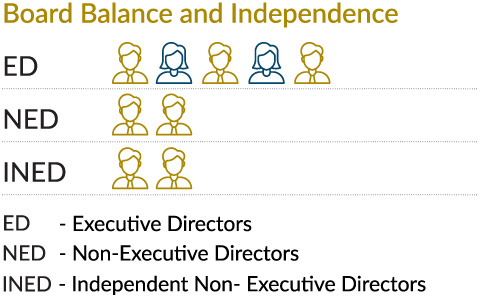

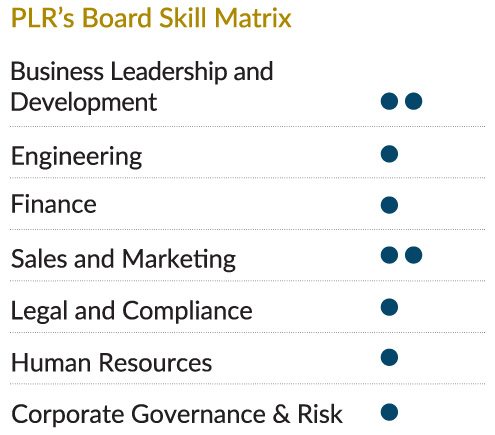

| The Board | A.1 | Complied | The PLR Board consists of nine directors, out of four are Non-Executive ensuring a suitable balance of power between Executive and Non-Executive Directors

is maintained. The Board is composed of skilled professionals in the fields

of business leadership, engineering, finance, sales and marketing, legal and compliance, human resources, corporate governance and risk. |

| Board Meetings | A.1.1 | Complied | Not applicable for 20/21, However 1st board meeting for 21/22 was held in Q1- and will be held on a quarterly basis thereon. |

| A.1.2 | Complied | The Board of Directors holds prime responsibility to ensure that risks are identified and appropriately managed across the Group. Directors are made aware of their duties and responsibilities with regard to monitoring and managing the risks associated with capitals, value creation activities, business operations and impacts. |

| A.1.3 | Complied | The Board collectively and Directors individually act in accordance with the laws of the Country and where ever required obtain independent professional advice. |

| A.1.4 | Complied | All Directors have access to the advice and services of the Company Secretary. |

| A.1.5 | Complied | All Directors exercise independent judgement in all decisions pertaining to strategy, performance, resource allocation, and standards of business conduct. |

| A.16 | Complied | Every Director dedicate adequate time and effort to matters of the Board and the Company.

The Board papers and the agenda are received by the Directors ahead of Board Meetings, enabling the Directors to review the papers and obtain clarifications ahead of the meetings. |

| A.17 | Complied | Any single Director may call for a resolution to be presented to the Board where he/she feels it is in the interest of the Company. As per Articles of Association, resolutions can be passed with majority voting. |

| A.1.8 | Complied | New training focuses on enabling the Directors to expand the knowledge and skills required to effectively perform duties as a Director.

|

| Chairman and CEO | A.2 | Complied | In order to ensure a clear division of responsibilities at the head of the Company and maintain a balance of power and authority, the positions of Co-Chairman, Co-Chairperson were created while the Managing Director holds the authority of CEO. |

| Chairman’s Role | A.3- A.3.1 | Complied | The Board is headed jointly by the Co-Chairman and Co-Chairperson, both of whom function in the capacity of Executive Directors. Together they are responsible for preserving order and facilitating the effective discharge of Board functions. The Co-Chairman and Co-Chairperson conduct Board proceedings and ensure the e effective participation and contribution of all Directors, the Directors are informed on the matters included in the agenda. |

| Financial Acumen | A.4 | Complied | The Board includes Directors who are skilled, experienced and possess the necessary knowledge and competence to offer expert opinion on financial matters to the Board.

The Audit Committee holds a special responsibility in discussing matters of Finance with the external and internal Auditors.

|

| Board Balance | A.5- A.5.1 | Complied | The Board has a balanced composition of five Executive Directors and four Non- Executive Directors. The Non- Executive Directors bring expertise on Finance, Marketing, Legal & Compliance, Corporate Governance & Risk and Human Resources. |

| 5.2 | Complied | The Articles of Association has provisions to appoint another Independent Director once a suitable Independent Director is identified. There are four Non- Executive Directors, of whom only two are independent (The Board balance is complied with the CSE Listing Rule requirements). |

| 5.3 | Complied | All the Independent Directors are independent of management and free of any business or other relationship that could materially interfere with. |

| 5.4 | Complied | All the Non-Executive Directors have signed the declaration of his independence or non-independence against the specified criteria set out in the Specimen in Schedule. |

| 5.5 | Complied | The determination as to the independence or non-independence of each Non- Executive Director is done. |

| 5.6 | Complied | No alternate Directors were appointed. |

| 5.7 | Complied | Mr. Deepal Sooriyaarachchi has been appointed as the Senior Independent Director as the Chairman is not an Independent Director. |

| 5.8 | Complied | The Senior Independent Director is available for confidential discussions, should there be any concerns regarding governance or issues that may adversely affect the Company, inadequately addressed by the Board. |

| 5.9-5.10 | Not Applicable for 20/21 | Holding Board meeting with the Non-Executive Directors was not required prior obtaining the PLC status. |

| Supply of Information | A.6.1

| Complied | The Board is provided with timely information in a form and of a quality appropriate to enable it to discharge its duties.

Directors make further inquiries where necessary if information provided by management not be enough. |

| A.6.2 | Complied | The Agenda for the Board meeting and connected discussion papers are ordinarily circulated to the Directors seven (7) days in advance to facilitate the effective conduct of the meeting. |

| Appointments to the Board | A.7.1 | Complied | The Nomination, Remuneration, Nomination and Human Resources Committee was appointed subsequent to the Company being listed. |

| 7.2 | Complied | The Nomination, Remuneration, Nomination and Human Resources Committee annually assesses Board composition. |

| 7.3 | Complied | The Colombo Stock Exchange is informed upon the appointment of a new Director to the Board, along with a brief resume of the Director which includes;

- the nature of his expertise in relevant functional area

- other Directorships or memberships in Board sub committees

- whether the Director is considered an Independent Director

|

| Re-election | A.8.1- 8.2 | Complied | The Articles provides for re-election, however no re-elections have taken place during the year under review. |

| Resignation | 8.3 | Complied | The Articles provides for resignation to be given in writing, however no resignations have taken place during the year under review. |

| Appraisal of Board Performance | A.9.1-9.4 | Not Applicable for 20/21 | |

| Disclosure of information in respect of Directors | A.10 | Complied | The details in respect of Directors will be disclosed in the Annual Report covering, as follows:

- Name, qualifications and brief profile

- The nature of his/her expertise in relevant functional areas

- Immediate family and/or material business relationships with other Directors of the Company

- If Directors have immediate family and/or material business relationships with other Directors of the Company

- Whether Executive, Non-Executive and/or Independent Director

- Names of listed companies in Sri Lanka in which the Director concerned serves as a Director

- Number/percentage of Board meetings of the Company a ended during the year – (Not Applicable for 20/21)

- The total number of Board seats held by each Director indicating listed and unlisted Companies and whether in an Executive or Non-Executive capacity

- Names of Board Committees in which the Director serves as Chairman or a member- Refer to the “Committees Reports”

- Number/percentage of committee meetings a ended during the year- (Not Applicable for 20/21)

|

Appraisal of Chief

Executive Officer | A.11 -

A.12 | Not

Applicable for 20/21 | |

| Directors’ Remuneration | B.1 | Complied | The Board has implemented a formal and transparent procedure for developing policies on remuneration by setting up a Remuneration Committee. Its purpose is to assist the Board of Directors in matters relating to compensation of the Company’s Directors and Key Management Personnel. |

| B.1.1-B.1.2 | Complied | Remuneration, Nomination and Human Resources Committee consist of Three Non-Executive Directors and the majority of them are independent. The Chairman of the Remuneration Committee –Mr. Deepal Sooriyaarachchi is an Independent Non-Executive Director. |

| 1.3 | Complied | Please Refer page 77 – for details on Remuneration, Nomination and Human Resources Committee |

| 1.4 | Complied | The Board as a whole determines the fees payable to the Non-Executive Directors. |

| 1.5 | Complied | Remuneration Committee consults the Chairman about its proposals relating to the remuneration of other Executive Directors. |

| The Level and Make up of Remuneration | B.2 | Complied | |

| Disclosure of Remuneration | B.3.1 | Complied | Annual Report contains the details of the Nomination, Remuneration and Human Resources Committee and details of remuneration of the Board as a whole. |

| Relationship with Shareholders | C.1-C.2 | Complied | |

Major and Material Transactions

| C.3.1-3.2 | Not Applicable

for 20/21 | As at the end of FY 20/21 PLR was not a Public Listed entity. Hence SEC and CSE rules mandating the disclosure of “Major related Party Transactions' ' to shareholders by the Board, was not required. However, the Related Party Transactions applicable for the FY 2020/21, is disclosed in the Annual Report

|

| Accountability and Audit | D | | |

| Financial and Business Reporting | D.1.1 | Complied | The Board has presented the Annual Report which includes the Financial Statements of the Company that is true and fair, balanced and understandable and prepared in accordance with LKASs and SLFRSs as required by statutory requirements. The Annual Report is compliant with Integrated Reporting standards. |

| D.1.2 | Complied | The Board is aware of its responsibility to present regulatory and statutory reporting and other price sensitive information in a balanced and understandable manner |

| D.1.3 | Complied | The General Manager-Finance and the Managing Director are responsible

for ensuring that, the financial records of the Company have been properly maintained and that the Financial Statements comply with the appropriate accounting standards and give a true and fair view of PLR’s performance for the financial year. The General Manager-Finance and the Managing Director are required to review quarterly and at the year-end, the Company’s Financial Statements before submitting them to the Audit Committee and the Board. |

| D.1.4 | Not Applicable

for 2020/21 | The Declarations that should be done by way of a Directors’ Report is not applicable prior to Listing.

|

| D.1.5 | Complied | Statement setting out the responsibilities of the Board of Directors for the preparation and presentation of financial statements (page 91) together with a statement by the Auditors about their reporting responsibilities (page 87) included |

| Summoning an Extra Ordinary General Meeting (EGM) to notify Serious loss of capital | D. 1.7 | Complied | Circumstances to summon an EGM did not arise during the year 20/21 |

| Related party transactions | D.18 | Complied | The transactions entered into by the Company with the related parties is disclosed on Note 32 of the Financial Statements |

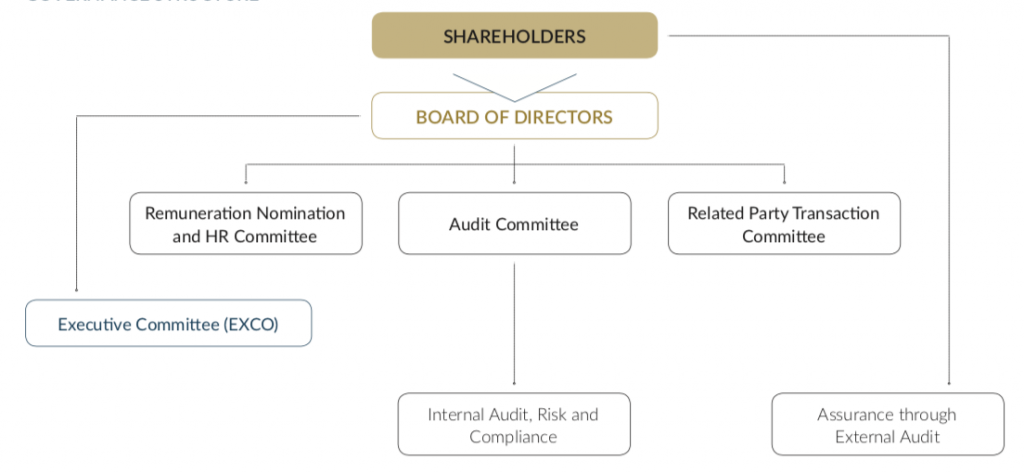

Risk Management and Internal

Control | D.2 | Complied | A risk management and internal control system was implemented by the Board under the Internal Audit, Risk and Compliance Department which will report to the Board Audit Committee. This department was established in April 2021. |

| D.2.1 | Complied | The Board has established a monitoring system to review Company’s risk management and internal control systems, however this is not applicable to the year under review |

Review the need for internal audit

function | D.2.2 | Complied | The Audit Committee was established to monitor, review, and evaluate the effectiveness of the risk management and internal control system |

| Internal Audit Function | D.2.3 | Complied | An internal audit function was established |

| D.2.4 | Complied | The Audit Committee has been established to ensure review of the process and effectiveness of risk management and internal controls and to report to the Board. |

| Audit Committee | D.3 | | |

| D.3.1 | Complied | The Audit Committee was established in the Q4 of 2020/21 Financial Year, and effectively commenced the work of the committee from Q1 of FY 2021/22 financial year.

The Committee consists of three Non-Executive Directors, of whom two are Independent. The Committee is Chaired by Mr. Sanjaya Bandara, who is an Independent Non-Executive Director. The members of the Committee possesses expertise in Finance, Risk and Governance compliance |

| D.3.2 | Complied | The Audit Committee has a written Terms of Reference covering its purpose, duties and responsibilities. |

| D.3.3 | Complied | Details on the Audit Committee, describing the scope of the committee in discharging its responsibilities is included in the Annual Report – page 77 |

Related Party Transactions

Review Committee | D.4

| | |

| D.4.1 | Complied | Related Party Transactions are de ned as LKAS 24 |

| D.4.2 | Complied | The Related Party Transactions Committee (RPTC) was established in the Q4 of 2020/21 Financial Year, and effectively commenced the work of the committee from Q1 of FY 2021/22 financial year.

At the start of the FY 2021/22 the composition of the RPTC was changed to include all Non-Executive Directors of whom, a majority is independent.

The Committee is Chaired by Mr. Sanjaya Bandara, who is an Independent Non-Executive Director. |

| D.4.3 | Complied | The Related Party Transaction Committee has a written Terms of Reference covering its purpose, duties and responsibilities. |

| Code of Business Conduct & Ethics | D.5.1 | Complied | The Company has adopted a Code of Business conduct and ethics and the Directors and Key Management Personnel are committed to the code and the principles contained therein. There were no reported cases of non-compliance to, Code of Business Ethics by any Director, Key Management Personnel or any other employee. |

| D.5.2 | Complied. (Not

Applicable for 20/21 | Company has established policy and process to ensure that material and price sensitive information is immediately disclosed to the Colombo Stock Exchange immediately after relevant decisions are made by the Board of Directors. However the disclosure requirement was not applicable to 20/21, before listing |

| D.5.3 | Complied (Not

Applicable for 20/21) | A process in place from 21/22 to monitor the share purchases by any Director and will be reported to the Company Secretary immediately to arrange necessary disclosure to the Colombo Stock Exchange. Shares purchased by Key Management Personnel or any other employee involved in financial reporting will be monitored by Manager-Compliance |

| D.5.4 | Complied | The Chairman’s affirmation in the Company’s Annual Report that he is not aware of any viola on of any of the provisions of the Code of Business Conduct & Ethics is on pages 74. |

Corporate Governance

Disclosures | D.6.1 | Complied | The Corporate Governance Report sets out the manner and extent to which the Company has complied with the principles and provisions of the code

|

Shareholder

Voting | E.1 | Not Applicable | |

| Evaluation of Governance Disclosures | E.2 | Not Applicable for 20/21 | (When evaluating the governance arrangements particularly, in relation to the Board structure and composition, institutional investors are encouraged to give due weight to all relevant factors drawn to their attention) |

| Other Investors | F | Not Applicable for 20/21 | |

| Internet of things and Cyber security | G | Complied | The policies on Governance of information systems, Intranet and Cyber security are currently been reviewed and aligned with the code |

| Environment, Society and Governance | H | Complied | Annual Report contains information on Environment (Environment Capital page 70), Social (Social Capital page 63) and Governance (Governance report page 74), that will enable investors and other stakeholders to assess how ESG risks and opportunities are recognized, managed, measured and reported. |