02

STRATEGIC

OVERVIEW

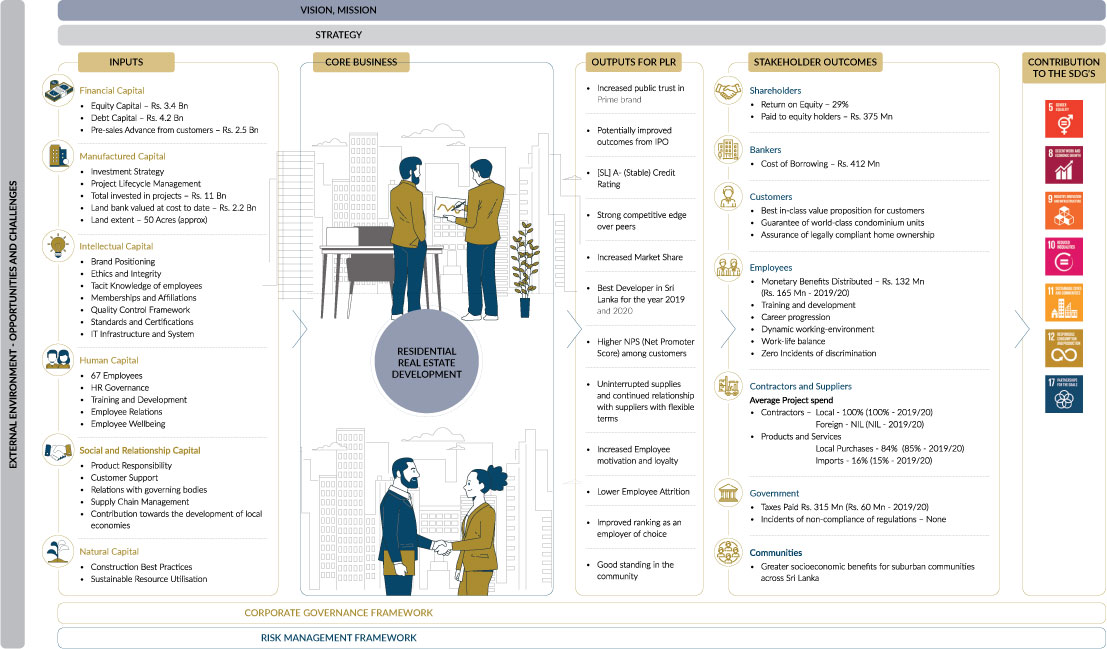

Value Creation Model

VISION, MISSION

STRATEGY

CONTRIBUTION

TO THE SDG'S

CORPORATE GOVERNANCE FRAMEWORK

RISK MANAGEMENT FRAMEWORK

Highlights

Key Risks

PLR’S APPROACH TO RISK MANAGEMENT

RISK GOVERNANCE

In its role as the highest governing body in the organisation, PLR’s Board of Directors are accountable to the Company’s shareholders for ensuring appropriate risk management frameworks are in place across the Company. The Board Audit Committee advises the Board on the Company’s risk controls and continues to guide the Board on developing a culture for risk management within the organization.

PLR’S transition from a family-owned Private Company to a Public ownership has emphasized the need for strengthening the Risk Culture of the Company. As a result, the Company has obtained the service of new Non- Executive Directors who are highly skilled and experienced in the sphere of Risk and Governance. Moreover as part of the overall approach to align with best practices for listed entities, a new department for Internal Audit, Risk and Compliance was formed in April 2021.

Under the purview of the Executive Management Committee, the overall reporting and monitoring system was streamlined to support comprehensive system generated management information for areas that were previously monitored through ad-hoc reporting mechanisms.

With the Board setting the tone from the top, the risk governance is further reinforced at all levels of the business through the three-lines-of-defense mechanism. The first line of defense are the primary risk owners – the department heads and their respective teams, who are responsible for risk management at an operational level.

Management of operational risk is delegated to relevant departments where employees are expected to use their knowledge and technical expertise to identify and control risks throughout their value chain.

Serving as the second line of defense is the newly formed Internal Audit, Risk and Compliance Department which is tasked with monitoring and evaluating the implementation of the Board approved framework of policies and procedures for the management of risk. Appropriate internal controls are in place to support this process, while routine Internal Audits are carried out as per the Audit Plan.

The Internal Audit, Risk and Compliance Department reports directly to the Board Audit Committee.

Independent assurance by the external auditors serve as the third line of defense in PLR’s Risk Governance Structure.

RISK GOVERNANCE STRUCTURE

RISK APPETITE

- Material financial loss

- Material breach of external regulations that could lead to loss of critical operational and business licenses, and / or substantial fines

- Material damage to the Company’s reputation and brand name

- Supply chain interruptions that could impact the continuity of the business

- Potentially hazardous conditions affecting the safety and health of employees

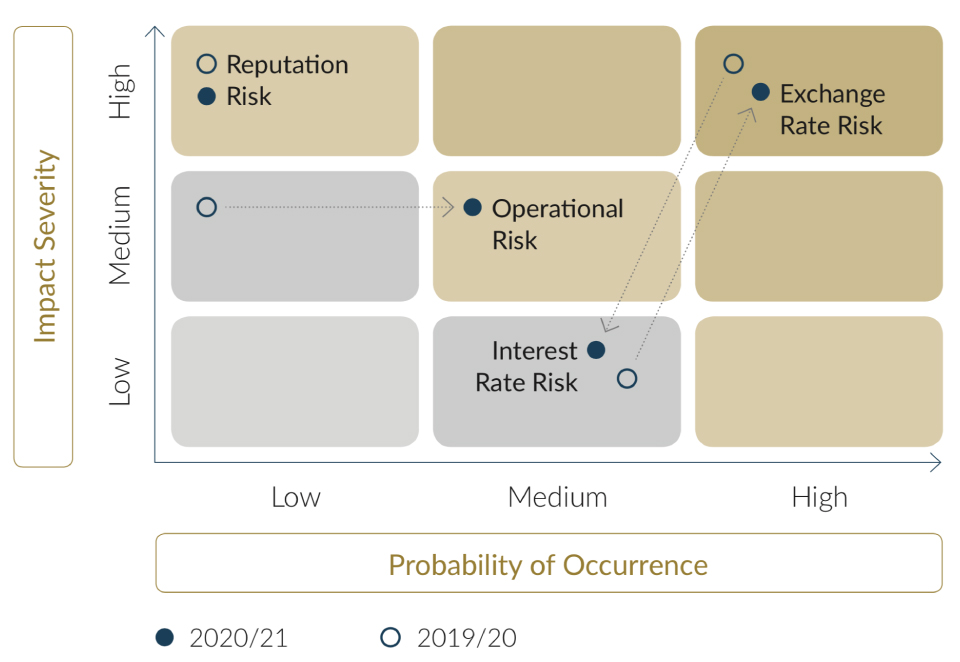

The Board has established risk profiling criteria in line with its risk appetite to help assess and prioritise each identified risk according to the severity with which it affects the Company and probability of occurrence. The key risks identified on this basis are depicted on the risk heat map below.

PLR’s Risk Heat Map 2020/21

MANAGING KEY RISKS

REPUTATION RISK

Key Risk Factor

- Customer satisfaction and complaints

- Repeat Customers

- Customer NPS (Net Promoter Score)

Mitigation Strategies

- A well-structured quality control system in place to ensure quality control is carried out systematically at each stage of completion.

- Quality Assurance is monitored and certified by reputed External Consultants

- Monthly Management Reviews where customer complaints concerning quality are brought to the attention of the Management Committee.

New Initiatives introduced in 2020/21

- Project reviews by the Executive Committee on a monthly basis

- Strengthening knowledge and skills at a leadership level to enhance project governance control

Focus for the Future

EXCHANGE RATE RISK

Key Risk Factor

Increase in the cost of imported material due to the depreciation

Mitigation Strategies

- Close monitoring of project cost to safeguard against significant variations from the project budget.

- Broad base the supply chain by growing the network of local suppliers

- Enter into Forward Exchange Contract with the banks in order to hedge the exchange risk (Currently suspended).

- Expedite the LC opening process in advance.

- Negotiate fixed price contracts by way of advance payment on unconditional Bank Guarantees.

- Regular price revision on unsold units in order to match the cost overrun due to exchange rate fluctuation and currency volatilities.

Oversight Responsibility

- Finance Department

- Engineering and Quality Assurance Department

- Quantity Surveying Department

- Procurement Management Division

INTEREST RATE RISK

Key Risk Factor

- Number of reservations

- Percentage of Cash collection

- Percentage increase in finance costs

Mitigation Strategies

- Having a diverse portfolio mix that caters to different market segments

- Offering flexible payment plans to customers settling through bank loans

- Continuously monitor trends in customer demands

- Liaise with banks and negotiate banking facilities based on AWPLR.

- Maintain strict control over the treasury management activities in line with bank borrowing rates

- A series of new innovative financial solutions were offered to customers to enable them to benefit from the low interest rates

- Present customers with a dynamic investment proposition that encourages them to make full payment upfront and enjoy a substantial discount

- Liaising with banks and the financial institutions in order to develop new lending products for the condominium sector.

- A concerted effort was also made to take advantage of the low interest rate environment in order to rationalise the Company’s debt portfolio

Oversight Responsibility

- Finance Department

- Sales, Customer Service and Recovery Department

OPERATIONAL RISK

Key Risk Factor

Mitigation Strategies

- Strict tender procedure is in place for the selection of contractors for each project

- Selected contractors sign a mandatory construction contract stipulating delivery project milestones for the entirety of the project

- Monitoring of project timelines monthly, based on expected milestones to ensure no major deviations take place

- Making sure contractors abide by the terms of construction contract, in the event of non-conformity consider alternatives

- Maintaining a diverse network of supply chain partners to be able to meet sourcing requirements locally

- Monthly Project Reviews

- Progress of projects are monitored by the Management Committee on a monthly basis

Oversight Responsibility

- Engineering and Quality Assurance Department

- Procurement Management Division

SPECIAL RISK MANAGEMENT INITIATIVES IN RESPONSE

TO THE COVID-19 PANDEMIC

With the outbreak of Global pandemic COVID-19, the Company’s value chain activities were impacted and interrupted in more than one way from customer interactions, employee engagement to supply of material and labour.

Taking immediate action at the onset of the pandemic, the PLR Board responded promptly to the “new normal work setup” with new control procedures being established to mitigate potential risks arising as a result of these new work practices.

The employees’ Health and Safety was recognized as an area of paramount importance with many new H&S guidelines and protocols implemented for the protection of employees. Remote working arrangements which had been practiced for years, were reviewed and extended to all staff during the 2-month islandwide lockdown with new workflow based technologies rolled out to maintain business continuity during this period. Meanwhile the risk associated with “work from home practices” was re-evaluated, with a special focus on information security and data protection. Accordingly, access control processes were tightened in order to further strengthen data security architecture, while IT functions were comprehensively reviewed to maximise the availability of IT infrastructure.

Meanwhile PLR was also presented with several opportunities owing to the macroeconomic conditions created by the COVID-19 pandemic. Most notably increase in NCPI based Inflation, the ban on vehicle imports and the low interest rate on Fixed Deposits, which made real estate a very promising investment alternative. The decline in interest rates which also meant lower borrowing costs for customers, in turn further fuelled the demand for condominiums. Amidst this backdrop, PLR redoubled efforts to capitalise on this trend by offering innovative financial solutions and attractive payment plans to acquire new customers.

Stakeholder Interactions

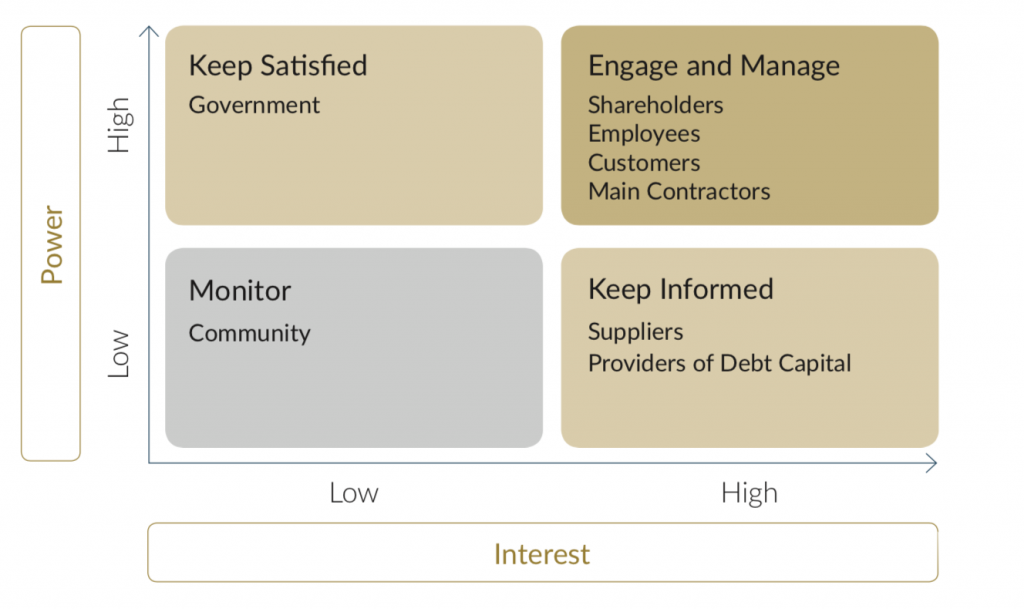

Stakeholder engagement enables us to listen, learn and exchange ideas on topics that impact our business and industry, as well as issues that impact the wider community and society as a whole. The feedback we receive from various stakeholders influence our strategy and operational decisions.

We have defined our key stakeholder groups as those who directly or indirectly impact our business, or those who are impacted by our operations.

On this basis we have determined our stakeholders to be; shareholders, customers, employees, main contractors and suppliers, the government and the community. Thereafter, we use the power-interest matrix to establish the scope and scale of the engagement and thereby establish the most effective mechanisms to interact with each stakeholder group.

STAKEHOLDER ENGAGEMENT MECHANISM

| Stakeholder | Engagement Mechanism | Frequency | Key Concerns Raised | Our Response |

|---|---|---|---|---|

Shareholders | Interim Financial Statements | Quarterly |

| PLR takes a prudent approach towards managing its financial resources, to ensure adequate resources are reinvested in the business, while fully honouring stakeholder obligations. |

| Annual Report & AGM | Annually | |||

| Announcements to the CSE | As required | |||

| PLR’s digital platforms | ||||

| Press releases | ||||

Employees | Employee relations framework | Continuous and Ongoing |

| PLR’s goal is to maintain a robust work environment that will help boost employee creativity and productivity in order to pave the way for all employees to achieve their professional and personal growth objectives. Moreover, stemming from our family-based management approach, we seek to promote a united, employee centric culture, where our people are considered as members of a close-knit family. |

| Other internal communication | ||||

| Training initiatives | ||||

| One-on-one discussions | As needed | |||

| Performance reviews | Mid-year and annually | |||

Customers | One to one interaction | As needed |

| PLR strives to provide an unrivalled value proposition coupled with the best in-class experience to earn and retain customer trust. |

| Marketing and promotional activities | ||||

| Press releases | ||||

| PLR’s digital platforms | Continuous and Ongoing | |||

Government | One-on-one meetings | As needed |

| PLR aims to lead by example in complying with all laws and regulations applicable to every aspect of the Company’s operations. |

| Compliance Verification Framework | ||||

| Compliance Audits | ||||

| Other correspondence | ||||

Contractors and Suppliers | One-on-one meetings | Continuous and Ongoing |

| PLR strives to build strong trust-based relationships with all suppliers including contractors. Contractors are selected based on a strict tender procedure, while other suppliers are comprehensively vetted to ensure their alignment with PLR’s ethical procurement standards. |

| Other correspondence | ||||

| Progress reviews | ||||

Providers of Debt Capital | One-on-one meetings | As needed |

| PLR aims to enhance its credibility among the banking sector by meeting all debt service obligation in a timely manner. |

| Other correspondence | ||||

| Annual Report | Annually | |||

Community | Annual Report | Annually |

| PLR remains committed to contribute towards improving community well-being and the development of sustainable communities across Sri Lanka. |

| PLR’s digital platforms | Continuous and Ongoing | |||

| Announcements to the CSE | As needed | |||

| Press releases |

FOCUS FOR THE FUTURE

Going forward, we are work towards introducing a more streamlined approach towards stakeholder engagement based on international best practices applicable to our business

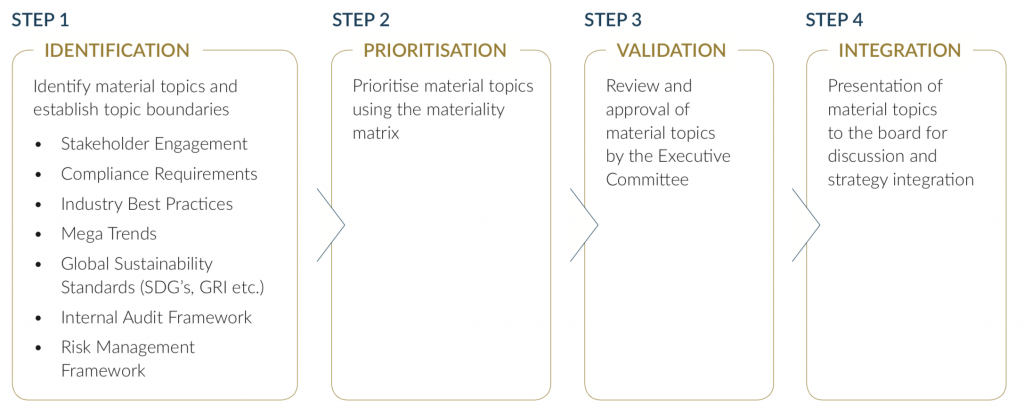

Material Topics

Material Topics are issues that have the potential to impact, either positively or negatively, PLR’s value creation in the short, medium and long term. Therefore effective management of these Material Topics is vital in supporting our ability to execute our strategy and remain competitive.

Based on the following four-step approach, a total of 15 Material Topics have been determined as relevant to PLR.

MATERIALITY MATRIX

- Profitability

- Financial Stability

- Land Bank

- Project Execution

- Brand Image

- Culture and Conduct

- Excellence in Quality

- Resilience and Business Continuity

- Customer Experience

- Supplier Relations

- Pay and Benefits

- Career Prospects

- Health and Wellbeing

- Community Impact

- Environmental Stewardship

| Material Topic | Topic Boundary | Why it is considered Material | Management Approach | Further References | Evaluating the effectiveness of our management approach |

|---|---|---|---|---|---|

| Profitability | Internal | Improves shareholder returns | Consistent revenue growth and strong cost management | Financial Capital - Page 47-48 | NPBT NPAT ROA |

| Financial Stability | Internal | Strengthens brand equity and strengthens resilience | Strike the optimal balance between equity, debt and investor funding | Financial Capital - Page 48 Manufactured Capital - Page 50 | Credit Rating No. of new projects |

| Land Bank | Internal / External | Drives expansion of the project pipeline | Investment Strategy | Manufactured Capital - Page 51 | Growth in Asset Base No. of new projects |

| Project Execution | Internal / External | To ensure on-time completion of projects | Project lifecycle management | Manufactured Capital - Page 51 | Project milestones |

| Brand Image | Internal / External | Reinforces PLR’s competitive position in the real estate industry | Brand Positioning Regulatory Compliance | Intellectual Capital - Page 54 | Industry recognition for the brand Compliance track record |

| Culture and Conduct | Internal / External | Builds trust among customers and strengthen public confidence in the brand | Ethics and Integrity Transparency of marketing information Confidentiality and Customer Data Privacy | Intellectual Capital - Page 56 Social and Relationship Capital - Page 68 | Complaints regarding ethics violations Incidents reported through the Whistleblower process |

| Excellence in Quality | Internal / External | Builds trust among customers and enhances PLR’s competitive edge | Tacit knowledge of employees Standards and Certifications Memberships and Affiliations Quality Control Framework | Intellectual Capital - Page 56 | Brand recognition Customer NPS (Net Promoter Score) Customer Feedback |

| Resilience and Business Continuity | Internal / External | Safeguards operations against unforeseen challenges | IT Infrastructure and Systems | Intellectual Capital - Page 57 | System downtime |

| Customer Experience | Internal / External | Builds trust among customers and strengthen public confidence in the brand | Product Responsibility Transparency of marketing information Confidentiality and Customer Data Privacy Customer Support | Social and Relationship Capital - Page 64 Social and Relationship Capital - Page 68 | Customer NPS (Net Promoter Score) Customer Feedback |

| Supplier Relationships | Internal / External | Minimises potential supply chain disruptions that could affect project timelines | Supply Chain Management | Social and Relationship Capital - Page 69 | Project milestones No. of suppliers working with the Company for over 3 years |

| Pay and Benefits | Internal | Helps to attract and retain the best in-class talent | Recruitment and Selection Remuneration and Benefits On-boarding | Human Capital - Page 60 | Employee Satisfaction level Employee attrition rate Ratio of female employees returning to work after maternity leave Investment in Employee Wellbeing |

| Career Prospects | Internal | Builds loyalty and gives employees a sense of ownership for the Company’s future | HR Governance Cadre Planning Training and Development Employee Relations |

||

| Health and Wellbeing | Internal | Increases employee motivation and satisfaction | Employee Wellbeing Employee Engagement | ||

| Community Impact | Internal / External | Reduces inequalities between regions | Contribution towards the development of local economies | Social and Relationship Capital - Page 69 | Urbanisation trends in the area |

| Environmental Stewardship | Internal / External | Supports the national environmental goals | Construction Best Practices Sustainable Resource Utilisations | Natural Capital - Page 71 | Incidents of non-compliance |

Strategy and

Resource Allocation

Based on the Material Topics identified through the materiality determination process, we have developed four strategic themes to drive PLR forward. Each strategic theme is in turn underpinned by a series of strategic imperatives, which serve as key catalysts for meeting stakeholder deliverables and for achieving our medium and long term growth objectives.

ACHIEVE FINANCIAL EXCELLENCE

- Strategic expansion of PLR’s land bank to facilitate continuous growth of the project pipeline

- Invest in new projects with the benchmark net margin

- Monitoring and control to ensure achievement of project milestones

- Streamlined procurement to support the achievement of project milestones

Key Highlights for 2020/21

- Invested Rs. 2.2 Bn on new land acquisitions (Land extent approx. 50 Acres)

- Leveraged on the low interest rates to rationalize debt

- Awarded an issuer rating of [SL] A-(Stable) by ICRA Lanka, a group company of Moody’s Investors Service

BE THE CONDOMINIUM DEVELOPER MOST TRUSTED BY CUSTOMERS

- Invest in condominium developments catering to diverse customer segments

- Build a strong brand presence

- Equitable pricing to match the profile of each customer segment

- Benchmark international standards for design, safety and construction quality

- Demonstrate compliance leadership

- On-time completion of projects

- 360-degree innovation to improve the customer value proposition

- Build customer intimacy through regular communication as well as clear and transparent disclosure of information

Key Highlights for 2020/21

- Rolled out a range of financial solutions and easy payment plans for customers

- Introduced a rage of digital tools to support customer need for information and feedback

Scorecard

EARN THE RESPECT OF THE WIDER COMMUNITY

- Expand the Company’s geographical presence

- Demonstrate compliance leadership

- Benchmark international green building standards

- Prioritize recycling and responsible waste disposal

Scorecard

- Recognition by LMD as one of the most respected entities

BE AMONG THE MOST PREFERRED EMPLOYER BRANDS

- Equal opportunities at every stage of the employment lifecycle

- Provide the necessary resources to support professional and personal growth of all employees

- Recognise and value employee commitment and loyalty

- Build a communicative culture based on an open door policy

- Prioritize the safety and wellbeing of all employees

Key Highlights for 2020/21

- Granted up to a 10% increment to all employees

- Performance bonus paid for the FY 2020/21

- Promoted 5 employees

- Work from home and other safety measures in response to the pandemic

Scorecard

Joint Statement by Co-Chairman

and Co-Chairperson

Mr. Premalal Brahmanage

Co-Chairman

Mr. Premalal Brahmanage

Co-Chairman

Ms. Sandamini Perera

Co-Chairperson

Dear Stakeholders,

It is with great pleasure that we welcome Prime Lands Residencies PLC’s (PLR) new shareholders. On that note we take pride in presenting the first-ever Integrated Annual Report published by the Company for the financial year ending 31st March 2021.

What PLR has achieved in this past year is remarkable, which we believe is due to our unwillingness to be defined by the COVID-19 pandemic or its challenges. Instead our response was based on ensuring that business would continue with minimal interruption and that we would be well-positioned to capitalise on available opportunities. Our strong brand presence, unique business model and competitive positioning allowed us to maintain a long-term view of our businesses, enabling us to make strategic decisions and proactively innovate to enhance PLR’s growth prospects. A culmination of these factors coupled with the commitment of our teams saw PLR achieving its best ever financial performance in the FY 2020/21, with both Revenue and NPAT reaching all- time high of Rs. 7.7 Bn and 989 Mn respectively for the year ending 31st March 2021.

In yet another significant achievement PLR became the only real estate developer in the Country to be awarded an issuer rating of [SL] A-(Stable) by ICRA Lanka, a group company of Moody’s Investors Service with a stable outlook. While testifying to the strength, credibility and long-term financial stability of our organization, a solid rating of this nature will certainly boost customer confidence.COMPETITIVE STRATEGY

Much of our success is also due to PLR’s competitive strategy. Since the inception, our competitive strategy has been based on being the most innovative condominium developer able to meet the demands of the market. Simply put, our competitive strategy hinges on a simple mantra – create innovative value propositions to secure first mover advantage in the chosen space. It is this ideology that led PLR to unveil the concept of ”affordable luxury” in 2013.

At a time when the condominiums in Sri Lanka was predominantly seen as a luxury offering catering to the high end customer segment, our decision to defy the norm and target the mainstream suburban market was so unconventional that it was singularly responsible for triggering a never before seen trend in the local real estate sector. Having been at the forefront of this change, PLR’s developments have earned the trust of customers and the wider community for its ability to transform suburban neighborhoods through iconic structures that are the epitome of functional living. Through our relentless commitment to innovation we have ensured that our value proposition evolves dynamically in tandem with current trends. This approach has propelled PLR into a class of its own as the leading innovator responsible for reinventing lifestyle apartment living in Sri Lanka on an ongoing basis.

While we are understandably proud of these achievements, we remain fully committed to pursue opportunities to broaden our reach across the Country. In doing so we want to allow more Sri Lankans to benefit from our unique value proposition that promises to create livable, loveable, neighbourhoods. It was this rationale that led to the launch of the first phase of “The Palace – Gampaha” in December 2020. Our decision to select Gampaha was based on several factors, including that it is currently considered to be one of the fastest developing districts in the Country, which has seen land prices in the area shooting up in the past few years. Also, being the region with highest overall population density and the fastest growing commercial sector, the Gampaha District boasts of the growing number of middle income earners, making it the ideal target to promote PLR’s “affordable luxury” concept. With the first phase of “The Palace – Gampaha”, proving to be a resounding success, we soon followed it up with the launch of phase II in May 2021.

Admittedly, while PLR’s core strategy has remained largely anchored to the mainstream residential market, we have over the years further strengthened our competitive position through innovative portfolio diversification strategies to increase our bandwidth in the local real estate sector.

Our portfolio of resort-style condominium developments in coastal hot spots around the Country are designed to satisfy a niche market of customers seeking destination living solutions. Meanwhile, our most recent foray into the ultra luxury segment through “The Grand” – Ward Place (Colombo 07), aims to offer a world class living experience at Sri Lanka’s most desirable address to appeal to discerning high end customers who demand the finer things in life. With a diversified portfolio of condominium assets to its name, PLR now leading the industry for both quality and volume.

A PLANNED TRANSITION

Reflecting on how far we have come over the past 13 years, it is very gratifying for us to note that we remain on track with our aspirations. Our journey, which has been pivoted on organic growth has brought us to exactly where we want to be. With our business and our brand stronger than ever, we felt there was no better time than to broad base the share ownership of the Company. Moving ahead swiftly we initiated a plan to divest 20% equity stake of the Company to the public. PLR’s Initial Public Offering (IPO) was structured to raise Rs. 1.95 Bn in two tranches, the first by offering 100 Mn shares at an issue price of Rs. 10.40 per share, to raise Rs. 1 Bn, with an option to issue a further Rs. 87.5 Mn at the same issue price per share. The first tranche of the IPO which opened on 11 May 2021 was oversubscribed on the close of the first day, while the second tranche which was activated a day later on 12th May 2021 was also oversubscribed by the close of that day.

We believe the full subscription of the IPO even in the midst of a pandemic, is a clear testament of the public trust in our brand and their recognition of what we do. We also wish to place on record that we made good on the commitment made to shareholders at the IPO stage, where we guaranteed to distribute up to 40% of profits for the current year by way of dividend. In this regard, a sum of Rs. 375 Mn was paid to shareholders by 2nd August 2021.

Moreover, as a listed entity PLR stands to benefit from tax concessions in the next term, including a sizable reduction in the aggregate income tax payable by the Company for the next financial year along with other tax concessions over the coming three years.

With the IPO in the works, we also focused on aligning our governance frameworks on par with the requirements for listed entities. Working towards adopting the principles set out in the Code of Best Practice on Corporate Governance issued by CA Sri Lanka, the Board Audit Committee , the Remuneration, Nomination and Human Resource Committee and the Related Party Transaction Review Committee were all appointed very early in February 2021. In line with best practices, all three committees are chaired by Independent Non-Executive Directors. While the implementation of the Corporate Governance best practices and was undertaken as part of PLR’s transition from a family owned Company to a listed entity, we hope that the early adoption of these best practices prove to our stakeholders, how committed the PLR Board is to promote a transparent corporate culture.

As part of this overall effort, we also began the task of reviewing and updating our policies and ethics framework to capture the requirements of listed entities. This process is currently ongoing and we expect it to be completed by the FY 2021/22.

OUTLOOK AND PROSPECTS

As Sri Lanka gathers momentum as a major emerging economy in the South Asian region and the Country’s housing market set to grow bullishly over the next decade, it is obvious that the demand-supply mismatch that exists now will become even more deeply pronounced in the years ahead. The latest available data suggests that Sri Lanka requires as much as 100,000 housing units country-wide at a given time, while the annual demand for luxury units is estimated to be approximately 1,700 units. Moreover it appears that the ratio of condos to landed houses in Colombo is at a ratio of 10%:90% which is significantly lower than other Asian cities such as Singapore (95%:5%), Bangkok (80%:20%), Central KL (70%:30%), Mumbai (99%:1%), Chennai (55%:45%) and Bangalore (65%:35%).

It is also interesting to note that the dynamics of Sri Lanka’s real estate market appear to be changing. If this past year is anything to go by, we are now slowly seeing a higher share of investors coming into the market in contrast to a few years ago where buying interest was driven primarily by residential needs. However the continuation of this momentum over the long term is predicted on several factors, but mainly on the availability of potential real estate investment opportunities around the Country.

It goes without saying that these conditions augur well for PLR, as we stand to gain significantly from the demand for suburban housing and new suburbs that is likely to emerge from around the Country in the coming years. Our land bank coupled with our drive to innovate and the synergies from our recent IPO, gives PLR a distinct edge in driving our efforts to fully catalyse these future opportunities.

Moreover, as customers become more sophisticated and their expectations go beyond product quality, to holistically review the credibility of the developer, PLR again stands out in a league of its own. With its established brand presence, solid financial credentials and being the one and only A- (stable) credit rated real estate developer in the Country, customers have the assurance that PLR is not only Sri Lanka’s leading developer and the most trusted by customers, but also among the most financially stable corporate entities in the Country.

Backed by PLR’s leadership position and long standing reputation in the industry we will also seek to play a leading role in reforming the local condominium industry. As a founding member of the Sri Lanka Condominium Developers Association we expect to drive this effort and hope to work closely with the membership to adopt benchmark standards and best practices that would create a cohesive framework for the industry as whole to mature and grow sustainably in the coming years.

BOARD CHANGES

To support Company’s transition to listed entity status, 4 new Non-Executive Directors were appointed to the PLR Board in the current financial year. Mr. Deepal Sooriyaarachchi was appointed to the Board as Senior Independent Director, while Mr. Sanjaya Bandara, Mr. Mahinda Perera and Mr. Dhammika Kalapuge were appointed Non-Executive Directors with effect from 03rd February 2021.

Mr. Nalinda Heenatigala who has functioned as an Executive Director was appointed as Director Corporate Affairs with effect from 30th June 2021.

We take this opportunity to welcome all the above newly appointed Board members.ACKNOWLEDGEMENTS

We wish to express our profound gratitude to our colleagues on the Board for their support in steering PLR to even greater heights in this past year. In the same spirit, we also wish to thank the management and the entire PLR team for their commitment to work together to bring success to the Company year after year.

A word of appreciation also to our regulators for their guidance and support over the years.

Last but not least, we wish to thank our valued shareholders, customers, contractors, numerous suppliers and other stakeholders for their trust and confidence placed in the Company. You remain the reason we are driven to innovate, succeed and grow.

Mr. Premalal Brahmanage

Co-Chairman

Ms. Sandamini Perera

Co-Chairperson

MD's Review

Mr. Manjula Weerakkody

Managing Director

Dear Stakeholders

As you are well aware the COVID-19 pandemic has been redirecting the course of life as we know it for more than a year and half now. And like all other organisations around the world, Prime Lands Residencies PLC (PLR) too was required to operate under these unprecedented circumstances.

However true to the PLR spirit I am proud to say that we looked beyond the challenges and persevered, confident that there are opportunities to be found amidst the chaos. And we were right.

The demand for real estate in Sri Lanka, especially residential condominiums continued to surge throughout the year, as investors were seen rushing to take advantage of the reduction in policy interest rates announced by the CBSL as part of its monetary policy easing measures in the wake of the pandemic induced economic slowdown. Similarly the ban on vehicle imports and the ongoing devaluation of the Rupee also appeared to be fuelling the interest in real estate, which I believe, were a few of the other contributory factors that worked in our favour in driving up the demand for condominiums. Amidst this backdrop, PLR’s strong market presence and solid brand reputation proved to be an invaluable advantage which enabled us to make solid progress on all fronts.

FINANCIAL RESULTS

Financially, PLR achieved several historical milestones. Revenue for the FY 2020/21 at Rs. 7.7 Bn was the highest ever recorded by the Company, in its 13-years history. It is also a massive 35% increase from the Rs. 5.7 Bn reported for the previous year. It is worth noting that almost 55% of the total Revenue for the current financial year is from our flagship project “The Grand” – Ward Place (Colombo 07).

Cascading from the strong topline results, PLR’s Operating Profit doubled from Rs. 794 Mn in 2019/20 to Rs. 1.59 Bn for FY 2020/21. Buttressed by the solid operating results, PLR recorded its best-ever bottom line performance. At Rs. 1.28 Bn PLR’s Net Profit before Tax for the FY 2020/21 recorded a massive six-fold increase over the Rs. 182 Mn reported in the previous financial year. This trend was mirrored in PLR’s Net Profit after Tax which grew by a staggering 656% year on year to just under Rs. 1 Bn for the FY 2020/21.

Meanwhile, we also seized the opportunity to rationalise our gearing and streamline our finance expenses on the back of the lower interest rate environment. Consequently PLR’s net borrowings as at 31st March 2021 stood at Rs. 1 Bn.

I am also deeply proud of the fact that PLR became the first ever and only real estate company in Sri Lanka to date, to be awarded an issuer rating of [SL] A- (Stable) by ICRA Lanka, a group company of Moodys Investors Service.

REVENUE

Rs. 7.7 Bn

(2020: Rs. 5.7 Bn)

OPERATING PROFIT

Rs. 1.59 Bn

(2020: Rs. 794 Mn)

OPERATIONAL PERFORMANCE

Despite facing a temporary setback in collections during the 2-month island- wide lockdown during the COVID -19 first wave, we were able to regularize our cash inflows from pre sales no sooner the lockdown restrictions were lifted.

At the same time moved ahead with aggressive marketing and promotional activities to capitalize on the heightened buying interest from customers both locally and overseas. We tapped into our database and began reaching out to existing customers as well. In parallel, we undertook a broad based social media campaign to reiterate PLR’s signature value proposition, which is premised on the concept of “affordable luxury” that offers a unique new dimension to apartment living through the creation of “Lifestyle apartments” in “livable and lovable neighborhoods”. Around the same time we also rolled out a series of stress-free financial solutions to help potential buyers to benefit from the low interest rate environment. In yet another proactive effort to support customers, we did not hesitate to pass down the reduction in the VAT rate from 15% to 8% and the abolition of NBT Act which came into effect in 01.12.2019 by appropriately repricing many of our newly launched projects. The VAT reduction and the removal of NBT also benefited PLR in managing unforeseen cost overruns in many of our ongoing projects, due to the rupee depreciation and pandemic related supply chain disruptions. As such we were able to maintain greater price consistency across unsold units in these projects as well. A combination of these factors ensured a steady demand for our condominiums throughout the current financial year.

We made excellent progress in our project pipeline as well. Apart from a few weeks in April 2020 at the onset of the initial lockdown, construction work on all our projects continued throughout the year which points to our ability to maintain uninterrupted operations even during such challenging times.

We expedited the remaining work on several of our projects, which were nearing completion. The Beachfront Uswetekeiyawa (UK I) was completed and handed over in July 2020, while Prime Residencies – Edmonton Road (II) was handed over in December 2020 and Prime Residencies – Castle Street in April 2020.

Meanwhile PLR’s largest and most ambitious project to date and the crown jewel in our portfolio, “The Grand- Ward Place (Colombo 7)” -moved ahead swiftly from mid-2020 onwards. And with more than 70% of the construction completed at the time of writing, I can safely say that “The Grand” is on track and progressing towards completion in 2022.

Of our other ongoing projects, the super structures for both the Java 25 and the Prime Desire were completed during the current financial year. With both now well into the finishing stage, I expect these projects too will be able to meet their completion dates by end 2021. Construction work on our resort-style apartments- The Beachfront Uswetekeiyawa (UK II) which began in the previous financial year, also moved ahead as planned.

It is with immense pride that I announce yet another major project by PLR – “The Palace – Gampaha” which was unveiled in December 2020. “The Palace – Gampaha”, marks the first step in our efforts to perpetuate PLR’s hallmark “affordable luxury” concept across the wider mainstream market. The tremendous response we received following the launch of the project gives me reason to believe that we have succeeded in doing just that.

PANDEMIC RESPONSE

There are many reasons for PLR’s success this past year. However, I believe the robustness of our IT infrastructure, well thought-out business continuity plans, the resilience of our staff and the commitment of our leaders to push for innovation, are the most critical success factors that allowed the Company to not only manage the pandemic situation, but effectively grow and thrive in this environment.

Our solid cloud-based infrastructure meant we were able to activate necessary protocols to enable our staff to transition seamlessly from the office environment to working from home, almost overnight. In fact, I find that the teams adapted remarkably well as many of them were already accustomed to the flexi-hours work arrangement which has been in place for some time now.

We continued with all planned human capital development activities throughout the year and reiterated our commitment to our employees by granting an annual salary increment of up to 10%. And although the mid-year review was not held in July 2020 due to practical reasons, we made sure that all employees received the final performance appraisal conducted after the conclusion of the FY 2020/21. Based on the results of the performance appraisal mechanisms, 5 employees were promoted during the year, while the performance-based bonus entitlements for the 2020/21 financial year were also paid in full.

REINVENTING FOR THE FUTURE

It is quite obvious that Sri Lanka’s residential real estate sector has changed dramatically in recent years, in particular the perceptions regarding condominiums. I believe PLR is in no small part responsible for this transformation. Since first pioneering the concept of “affordable luxury” way back in 2013, PLR has stayed firmly anchored to the fundamental ideology to create world-class suburban neighbourhoods. With over 34 fully completed projects to date, we have earned the trust and respect of our customers by fulfilling their dream of home ownership through the provision of consistent high quality developments that are altogether more affordable.

From this foundation of trust, we are now looking to pave the way for the next phase in PLR’s growth journey. Towards this end we took the first steps in what would be an ambitious rebrand to set PLR apart as the leading innovator and the overwhelming trend setter in the local real estate sector. Through the rebrand, which would be under the theme “Opening doors for progress” we are aiming to raise PLR’s profile as a value creator for all stakeholders – shareholders, customers, employees, business partners as well as the wider community.

MOVING AHEAD

Coming off what has been the most successful year in our history, I remain very optimistic for PLR’s prospects for the future for I believe we are now at the start of the next big growth phase. I am quite certain that Sri Lanka’s real estate sector too will remain very conducive for growth. Going by the performance in the recent past, I am quite sure the sector will evolve at a faster pace in the coming years with the market becoming significantly more mature over the next 5 – 10 year time frame. In this scenario I expect condominium living to be accepted by mainstream markets across the Country.

Capitalising on these opportunities will be PLR’s foremost priority, going forward. While our reputation and good standing in the industry will definitely hold us in good stead, I firmly believe innovation will be the key catalyst that would provide a vital first-mover advantage. Our goal is therefore to pursue a 360-degree innovation strategy that will go hand in hand with our new brand purpose “opening doors for progress” for all.

APPRECIATIONS

In closing, I would like to express my gratitude to the Co-Chairman, Co- Chairperson and all Members of the PLR Board for their guidance and continued support. Let me also take this opportunity to thank our energetic team of employees headed by PLR’s Executive Committee and the Group’s shared services teams, for their unequivocal commitment.

A special word of thanks to all the regulatory authorities for their continued support.

And finally, I wish to thank our shareholders, customers, , business partners and bankers, for their support over the years. I look forward to your patronage as Prime Lands Residencies PLC enters a new and exciting growth phase in the coming years.

Managing Director